Breaking Bad

Kabezo Weekly Newsletter

Things are breaking. It is bad.

The markets were destroyers of narratives this week as prices reacted to macroeconomic data opposite to the logic of mainstream punditry.

The main event was U.S. February non-farm payroll data that came in at 311,000, far higher than consensus forecasts of 205,000. According to the dominant narrative, prices for stocks and bonds would be expected to drop and interest rates to go higher as evidence of a strong economy would presage a demand for money and continued monetary tightening by the U.S. federal Reserve.

Markets broke that narrative by sending rates sharply lower. With 2-year Treasuries yielding less than the current Fed Funds overnight policy rate, the bond market is newly confident that it is the Fed that will be brought into line, not the market.

Why did the markets have a sudden change of heart merely days after finally being brought into line by the rhetoric of Fed governors?

The collapse of Silicon Valley Bank (SVB) might have had something to do with it. The bank of billionaire tech bros and venture capitalists, was so undone by their bond portfolio that they could not even make it to Friday’s close before the Federal Deposit Insurance Corporation (FDIC) had to take control of it. The good news? Deposits are insured by the FDIC – up to $250,000. The bad news? Most of the depositors had balances far in excess of $250k.

Too Much Money

How did SVB get itself into such a mess? They had too much money.

Huh?

It goes back to what the U.S. Federal Reserve has been cooking in their laboratory since 2009. With interest rates and bond yields at zero, capital finds its way into crazy places to earn returns. Plenty of it found its way into west coast venture capital – and then into SVB, where management rightly thought of keeping it safe and liquid. Ooops.

Since VCs and tech bros had so much money, SVB did not have a big lending business. To earn yield they bought super-duper-ultra-safe U.S. Treasury bonds and agency mortgage-backed securities. Unfortunately, with the Fed raising the Fed Funds policy rate from zero to 4.75% over the last year, that bond portfolio now smells like low tide in the marsh on a hot summer day.

Sound familiar? I know, right? I wrote the same thing last week about Silvergate Bank.

But SVB is soooooo Friday. Let’s talk about something more current.

The same thing that happened to Silvergate last week, and then SVB on Friday, happened to Signature Bank New York on Sunday.

It looks like lending money to the U.S. government via the Treasury bond market is so risky that three banks were vaporized doing it.

So why are bond prices higher (and interest rates lower)? Same reason as always: more buyers than sellers.

Why are there so many buyers when the Fed and ECB are planning rate hikes this month? Nobody knows.

But it makes sense to me for a couple of reasons.

Reason 1: Large depositors are rightly spooked that a bank with $175 billion in deposits can go *poof*. Even if the FDIC does a good job liquidating portfolios and making uninsured depositors whole, this is a stressful reminder that when you deposit money in a bank, it is no longer yours. Owning government bonds is very different from depositing money in a bank. While bonds do not have a slick internet portal to pay employees and vendors, at least you can be sure you will get it back. This is one of the reasons bonds in Germany, Switzerland and other countries had negative yield from 2019 until this time last year.

Reason 2: It is highly unlikely that the three banks that used to be in business 10 days ago are the only ones with problem losses on their bond books. And the unknown banks that are under stress are probably a lot less hated than crypto bros’ banks. This will be an incentive for the Fed to grant some relief in the form of easier credit.

It has already begun with the announcement by the Fed of a $25 billion Bank Term Funding Program (BTFP) to help banks in distress.

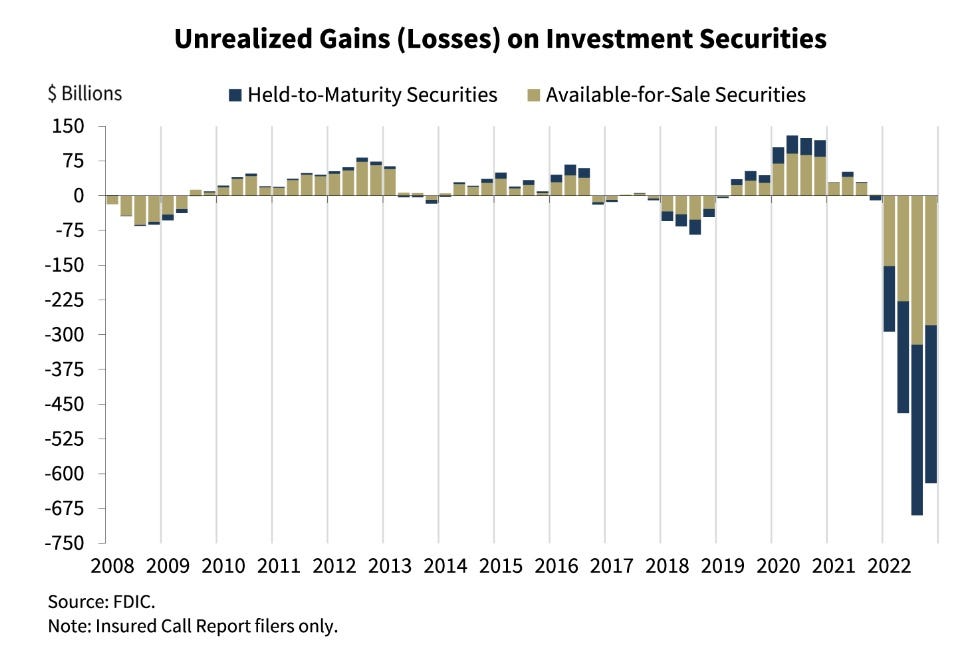

Bank runs on $275 billion in deposits is a very bad sign, even if most of the deposits were from loathsome billionaire tech bros and hated crypto bros. The authorities running the monetary system know that even if the political fallout is thin, the cause of the panic is affecting almost every bank in the country with varying severity. Banks are sitting on massive losses on their bond portfolios. This is dramatically illustrated in one slide of a presentation made by FDIC Chairman Martin Gruenberg on February 28th.

This slide basically shows the aggregate performance of U.S. banks’ bond portfolios since 2008. The FDIC thinks that banks are sitting on unrealized losses of $620 billion in the fourth quarter of 2022. That is a very big number, approximately equal to 25% of aggregate bank equity. This would include that of #1 JP Morgan and #2 Bank of America which are in better shape owing to their diversified depositor base – and implied government backing as systemically important banks. Most of the smaller regional banks are in much worse shape.

As Gruenberg himself points out, if depositors decide to withdraw their money, those losses will become real. Moreover, the selling of those securities to fund withdrawals could cause greater losses, and cascading waves of selling.

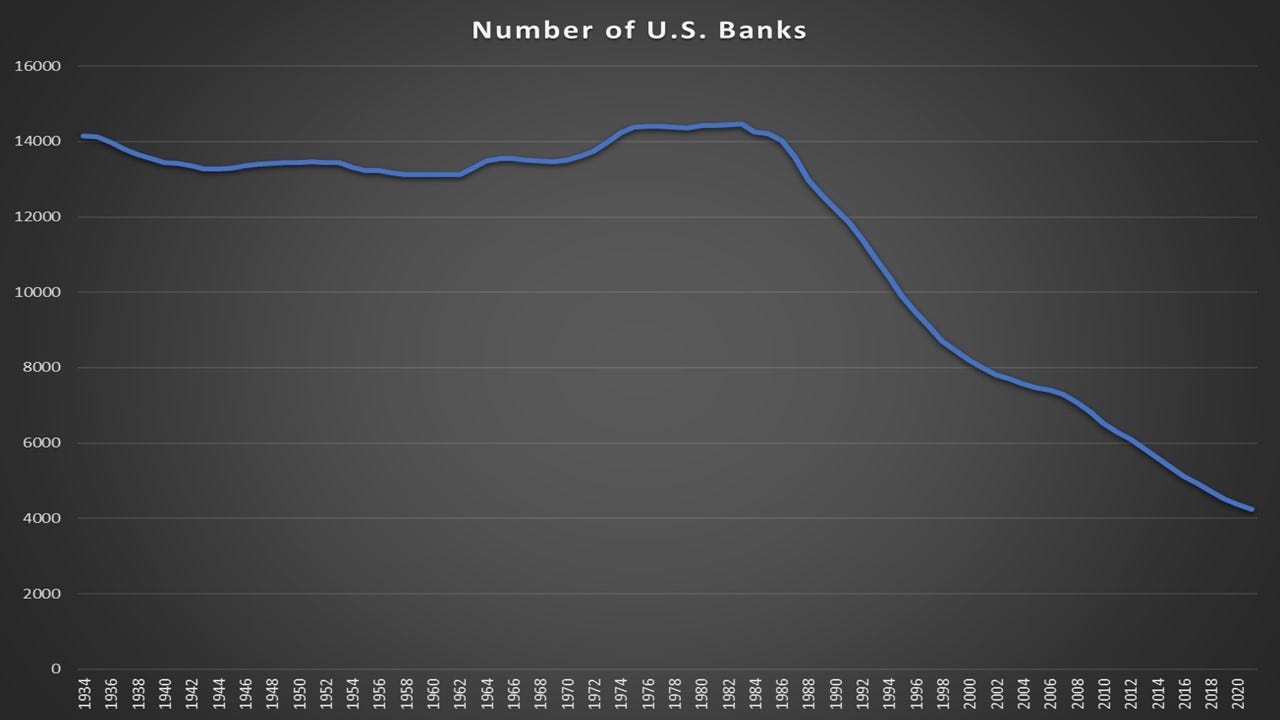

The immediate effect is a continuation of a trend that began in the 1980s when Fed Chairman Paul Volcker sharply raised rates to fight inflation. About a third of smaller banks and especially Saving and Loan Associations (S&L) failed or were restructured and bought by larger institutions. The result was a decline in the number of banks and an increase in their size. Three more banks bit the dust this week. But those deposits will eventually go somewhere, and the big banks will get bigger.

The inversion in the widely watched 2-year versus 10-year Treasury spread eased significantly this week. There are at least two ways this inversion can be resolved. Investors can sell long-dated bonds, sending corresponding rates higher. Or the Fed can lower the policy rate, which greatly influences the short end of the curve (although those mechanics are sketchy).

The market is speaking. The yield on 2-year Treasuries at 4.0% is currently 0.50% below the bottom of the Fed Funds tarket range. The market is expecting rate cuts sooner rather than later.

Of course, both things can happen at the same time as well. Yikes!

With headline inflation over 9% last summer, pundits were understandably worried about a bond market crisis when 10-year yields were under 3.4%. It has yet to materialize. But it would be ironic if bonds sold off now for deflationary reasons instead of a panic over inflation.

The Saftey of Crypto?

Where does crypto fit into all of this? Higher.

This makes a bit of sense as well. Bank failures do nothing to detract from the value proposition of crypto.

Most large cap coins are up at least 10% off the lows of last week in choppy trading.

The big question is where will crypto firms be able to bank? Silvergate, and Signature were the main U.S. bridges to the fiat system. SVB was a smaller crypto player – except for the fact the USDC issuer Circle was a client and held upwards of $3 billion in reserve deposits there.

Acknowledgement of this by Circle caused a chaotic USDC de-peg down to $0.88 before trending back over $0.99 on soothing comments by Circle CEO Jeremy Allaire. Interestingly USDT steadied above par and traded as high as $1.02. I have to admit, Tether as a safe-haven was not one of my predictions for 2023.

For crypto at least, the bad-news-is-good-news trade is back on. Three tech-focused banks are gone. But it seems like the markets are taking this as sign that the good ole days of Quantitative Easing (QE) are coming back, and that Fed Chairman Jerome Powell will blink when confronted with wreckage of banks’ bond portfolios that can plausibly be traced back to moves by the FOMC.

The alternative is a continued culling of banks by the bond market. Crypto has SBF, 3AC Do Kwon and many more. I do not think Powell will want to compete with them, to be the Lord Voldemort of the banking sector.

I bet this is just the beginning. I am going to say it folks: forget about rate rises at the next FOMC meeting. Rate cuts are on the way. Nobody knows if this will lead to a sustained rally in crypto. But from the monetary standpoint, the stage is set.